POD stands for “payable on death,” which means that the owner of the bank account designated a beneficiary or beneficiaries to receive the balance of the account upon the owner’s death. Another name used for a POD account is “Totten trust.” It is also referred to as a “poor person’s trust” because there is no cost and little red tape to create one, and no cost and little red tape to assume ownership of one.

There can be POD checking accounts and POD savings accounts and POD certificates of deposit and other investment and banking instruments. As far as how to set up a payable upon death account, you will need to complete the necessary payable on death account forms, which your banking institution will provide (many provide them online). You can designate a single beneficiary or multiple beneficiaries for your POD account.

You would think there would be a lot of POD bank account rules, however, all a beneficiary has to do to claim the account is to show up at the lending institution with a death certificate and proof of identity.

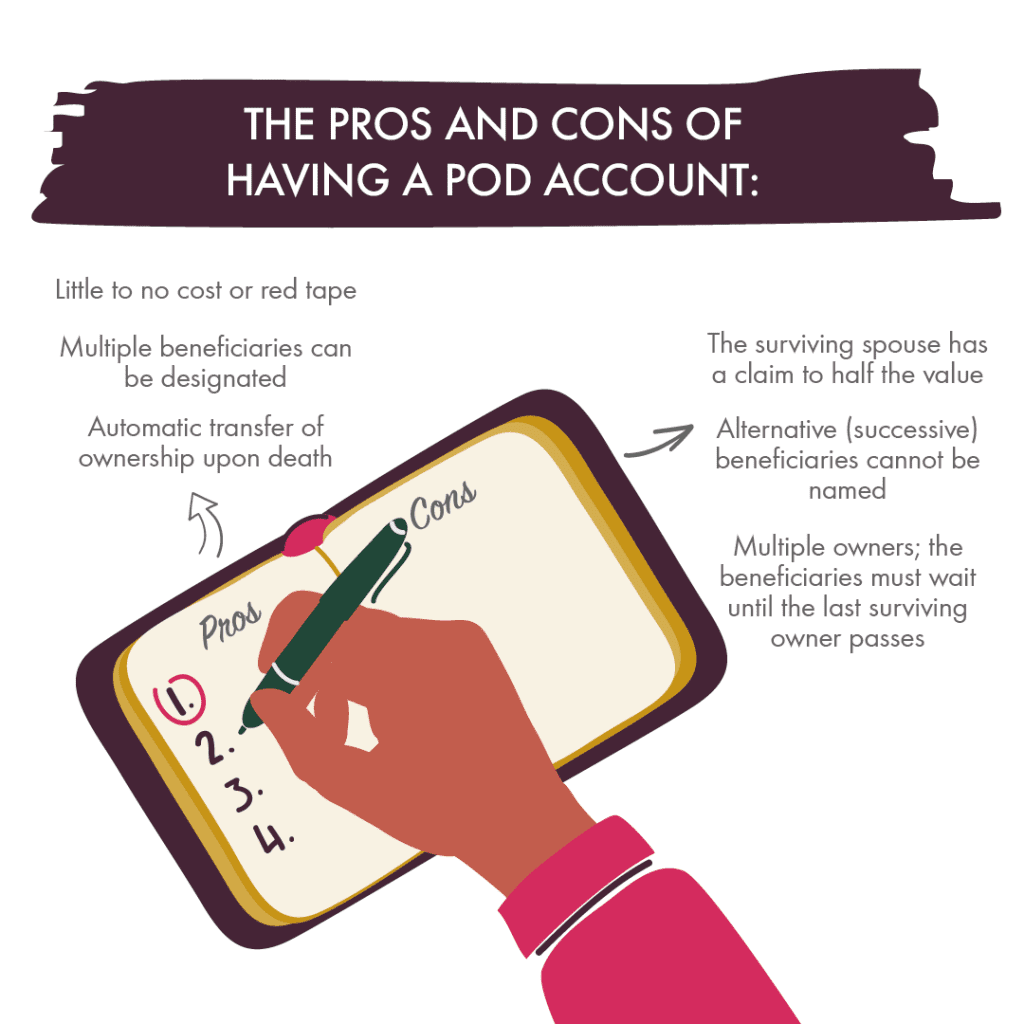

Individuals generally set up a POD account to keep their money out of probate court and facilitate the passing of their assets to their beneficiary or beneficiaries. The named beneficiaries cannot access the funds in the POD account until the owner passes, at which time ownership automatically transfers.

Yes. The subject of frequent litigation is when the owner designated a certain beneficiary for his or her POD account with the banking institution, but then used language in his or her Last Will & Testament that contradicts that designation.

The balance on the day of the owner’s death is not usually included in the taxable income of the beneficiary or beneficiaries because bequests are not taxable as income. However, the income earned by the account must be reported on the decedent’s final income tax return.

READ MORE: Estate Tax vs. Inheritance Tax: What’s The Difference?

Both Trusts and POD accounts are effective ways to avoid probate, but there are three situations in which a trust will work better.

The first is that a trust can provide the owner with great flexibility. While a banking institution will not permit the owner of a POD account to name alternate or contingent beneficiaries (i.e., name a succession of beneficiaries in case one or more predeceases the account owner), a trust will.

The second is that a beneficiary of a POD account is required to take possession of the balance of the POD account within a certain time after the owner’s death. This is established by state law and varies state-to-state. The result of this rule is that if a beneficiary is caught going through a bankruptcy filing or a divorce at that time, the bequest could be split with an ex-spouse or taken wholly or in part by his or her creditors according to bankruptcy law. In contrast, a beneficiary of a trust can hold those funds in trust for as long as needed to protect the bequest from the claims of an ex-spouse or of creditors.

The last consideration is avoiding the estate tax. POD accounts can be subject to estate tax depending upon the size of the estate, while funds held in trust are not.

©2011-2025 Worthy, Inc. All rights reserved.

Worthy, Inc. operates from 25 West 45th St., 2nd Floor, New York, NY 10036