The death of a loved one is more than an emotional experience, it’s a financial matter, especially if you are an inheritor. If you have been bequeathed a sum of money, artwork, personal mementos, real estate, jewelry, or otherwise, there will be lawyers to meet and papers to sign. If the inheritance process is new to you, it’s essential to understand the related terms to ensure that your loved one’s wishes are carried out and you receive the inheritance earmarked for you.

Everyone has an estate, whether a one-percenter, a member of the middle class, or a person who is barely getting by. In the simplest terms, an estate is a person’s net worth – the sum of their assets, minus any liabilities – at any given time.

After a person dies, the process of estate administration involves the collection of probate assets, the paying of creditors, and distribution of the remaining assets to his or her beneficiaries per the terms of the deceased’s will.

A will is a legal document that identifies how a person wants their property to be distributed upon their death and appoints a guardian for their minor children. A will should be as detailed as possible – any assets that are in your name but have no named beneficiary will be subject to probate.

The person tasked with the responsibility of distributing assets is named in will as the executor. If an executor is not named in the document, the court will appoint one. The beneficiaries are the people named in a will or trust as the recipients of the deceased’s estate, for better or for worse. You may not want to inherit your grandmother’s house but if so named, it’s yours, unless you disclaim the benefit and it passes to the next beneficiary.

If a person dies without a valid will – a situation known as intestate – the state in which they lived will essentially create a will for them, distributing their wealth per legal statutes in a way that the average person might have designated their assets to be distributed. The only property not subject to intestate probate is anything that has a named beneficiary, such as a life insurance policy or deed. Unfortunately, this intestate inheritance can differ greatly from what a person may have wished.

The heirs who are eligible to inherit through intestate succession typically fall into the following order:

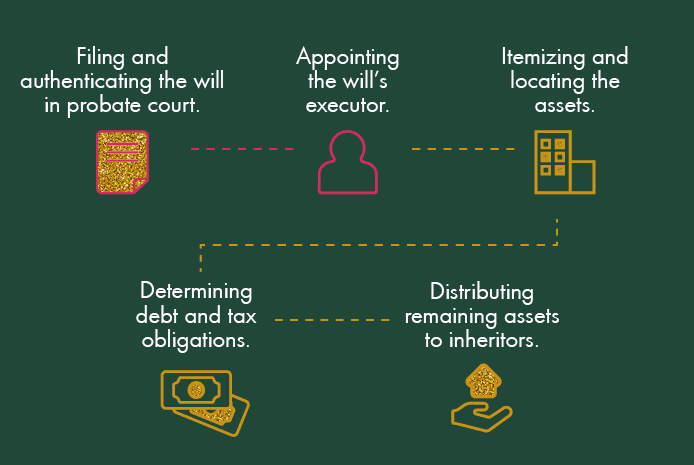

The executor of an estate is responsible for tackling the probate process, which involves filing the deceased’s will in probate court, notifying the inheritors, settling debts, and itemizing the property of the deceased.

Probate can take months to complete, and the accumulated fees can take a sizeable chunk out of the value of the estate, especially if heirs are arguing about inheritance or the validity of the will is challenged. The bigger the estate, the higher the probate costs are likely to be.

Some people opt for a trust instead of a will because it serves a similar purpose to a will, excludes the probate process, and allows for flexibility so you can change the terms of the trust any time during your lifetime. A trust also allows for some privacy because it is not required to be filed in court and is speedier in settling an estate than a will.

A person’s assets in a trust are given to another person or institution, like a lawyer or bank, called a trustee. The trustee legally holds the assets for another person, known as the beneficiary, and is responsible for handling the assets, tax filings, and distribution of the assets according to the terms of the trust, such as the delivery of a piece of jewelry to a granddaughter on her wedding day, or the disbursement of funds when a beneficiary turns 21.

All the beneficiaries named in a trust are entitled to a copy of the trust agreement so they know what is in the trust, what they are inheriting, and when.

Estate tax, also called the “death tax”, is a tax imposed on a person’s estate after their death. It only applies in the event that the value of the estate exceeds the limit established by the law and, in that case, only the amount over the limit is taxed. Inheritance tax is applied to the amount of money that each of the estate’s beneficiaries inherits.

Read more on Estate and Inheritance Tax

Jewelry is another asset often left to beneficiaries in an inheritance and, more often than not, while the piece is meaningful, the inheritor has no use for these pieces. At Worthy, we help our clients sell inherited jewelry in a safe, easy, and transparent environment where they can understand every aspect of the sale and make the choice that feels right for them. We know that selling inherited jewelry can be an emotional process and we strive to provide support the entire way through. You can learn more about selling estate jewelry, what you can do with this jewelry, how selling can help your finances, and hear first hand experience from one of our sellers.

Read about inheritance process in Pennsylvania

©2011-2025 Worthy, Inc. All rights reserved.

Worthy, Inc. operates from 25 West 45th St., 2nd Floor, New York, NY 10036